Personal Injury, Employment, Elder Abuse,

Civil Rights Attorneys Across California

We live here, we work here, we win here.

Se Habla Español

Need Legal Help Now?

Dial #4Help (#44357)

Get immediate access to the Dolan Law Firm by dialing #4Help (#44357) on your mobile phone. No searching, no stress. Our trial-tested team handles serious personal injury (auto, slip & fall, elder abuse, sexual assault, civil rights, wrongful death) and employment cases (wrongful termination, discrimination, maternity-leave violations, harassment). Serving clients across California with compassion and relentless advocacy.

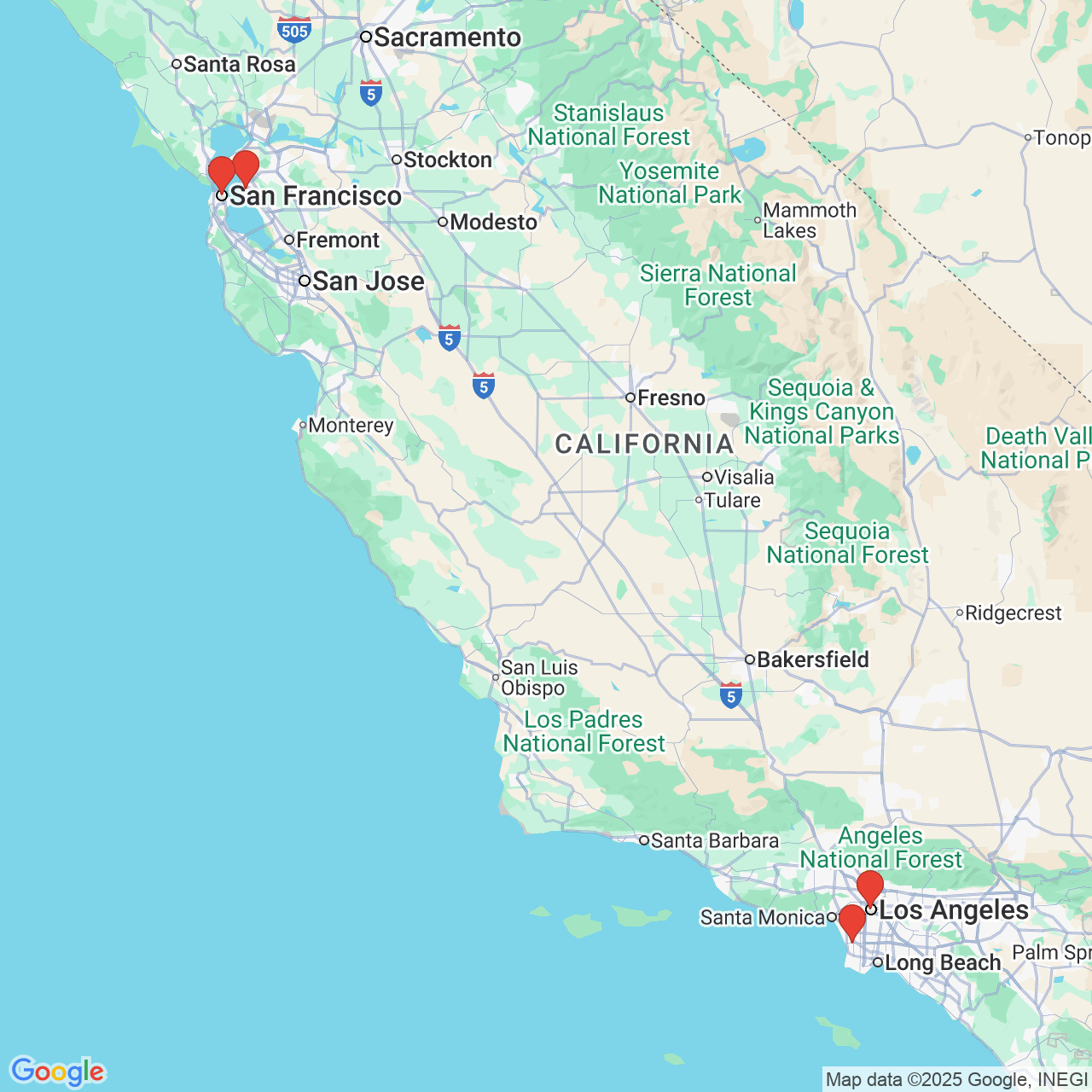

San Francisco

1438 Market St, San Francisco, CA 94102

Oakland

1498 Alice St, Oakland, CA 94612

Los Angeles

145 S Spring St Suite 800, Los Angeles, CA 90012

Redondo Beach

2614 Artesia Blvd, Redondo Beach, CA 90278

A Proven Partner for Justice

Dolan Law Firm has achieved big victories for victims, yet remains small enough to provide the personalized attention your case needs and deserves. If you feel like your back is against the wall, you have everything to gain by reaching out to us now.

You have only two years from the date of your accident to take action—request your free consultation today to learn why so many people in your position place their trust in Dolan Law Firm.

"They responded promptly and reassured me with all questions and concerns I had. They got me the justice that I deserve and made it happen very quickly. I would use them a thousand more times if I could and would highly recommend them.” - Jasmine, 5-Star Google Review

Christopher B. Dolan

Christopher Dolan is no stranger to financial success, having secured a total of more than 10 figures for victims of negligence, civil rights violations, and other personal injuries. But his ultimate priority is achieving justice for those who need it most. This has often led to advocating for clients at no charge, as in the case of Jahi McNath, a child whose parents contested a declaration of brain death while in the care of Children's Hospital Oakland.

Every case litigated by Dolan Law Firm is supervised by Mr. Dolan, who has personally obtained more than 26 settlements and jury awards that exceeded $1 million. Many of these victories represent significant uphill battles, such as a discrimination case both the NAACP and ACLU rejected, and a $20 million whistleblower retaliation case against Wyndham Vacation Ownership, the nation’s largest timeshare company. If you have been injured and it seems like the odds are against you, Dolan Law Firm can stand up to any responsible party.

Rated Highly By:

Multimillion-Dollar

Victories

In 36+ Settlements & Verdicts

“We want to make sure we are doing good in the world.

Our firm is not turning tragedy into money; we want to provide the best service for people in need.”

Christopher Dolan

A Steady Guide in Desperate Situations

Our track record of success in cases other firms won't take is just one reason why clients facing seemingly impossible challenges call us. They also trust us because:

“This firm cares about people's experience and I definitely felt that when we began working together. The staff at Dolan made sure I was informed about processes and answered any questions I had a long the way. I truly felt heard and would recommend them to anyone experiencing injury related accidents."

- Jose L., 5-Star Google Review

Our Services

- Auto Accidents

- Brain Injury

- Broken Bone Injury

- Car Accidents

- Truck Accidents

- Slip and Fall

- Employment Law

- FMLA Attorney

- Maternity Leave

- Wage and Hour Claims for Vacation Time

- Workplace Harassment Lawyer

- Workplace Injury

- Wrongful Termination

- Discrimination

- Disability Discrimination Lawyer

- Gender Discrimination

- Housing Discrimination Lawyer

- Racial Discrimination

- Sexual Orientation Discrimination Lawyer

- Workplace Discrimination Lawyer