Written By Christopher B. Dolan and Kimberly E. Levy

This week’s question comes from Kate R. from Oakland:

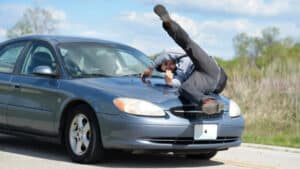

I was rear-ended on the freeway a few days ago and the driver that hit me fled the scene. The police took a report but have not been able to identify the other driver. I ended up in the hospital with some serious injuries. I am not going to be able to go back to work for a few weeks, at least. The bills for my medical care are going to start piling up. I have no idea what to do. Please help.

Thank you for reaching out, Kate. We’re sorry to hear about what happened to you and hope that you make a speedy recovery. Navigating the claim process for a hit and run case can be complicated. The good news is that you may have purchased several types of insurance coverages that can help you through this difficult time.

Medical Payments Coverage (“Med Pay”):

What is it?

Med pay is an optional coverage that is part of your individual car insurance policy. Med pay covers reasonable and necessary medical bills when you (or your passengers) are injured in an accident. Med pay will even cover your reasonably necessary medical expenses if you are injured as a pedestrian or passenger in someone else’s car. This coverage applies regardless of who is at fault for the collision.

How does it work?

There are two ways that med pay typically works:

- You go to the medical provider of your choice and the provider bills the med pay directly as if it were health insurance; or

- You submit bills and records to your insurance company for reimbursement of paid or outstanding bills.

Why do I need this coverage if I have health insurance?

There are several reasons this coverage is useful even if you have health insurance.

- First, health insurance often leaves you to pick up the tab for co-pays and co-insurance amounts. With med pay coverage, you can be reimbursed for these out-of-pocket costs.

- Second, med pay enables injured people to seek treatment that would not normally be covered by their health insurance policy, i.e., acupuncture, massage, and other alternative treatments. Finally, med pay allows you to seek a second opinion by a medical provider of your choice which is often beneficial when your health insurance coverage is an HMO plan.

Uninsured/Underinsured Motorist Bodily Injury Coverage (“UM/UIM”):

What is it?

Uninsured/underinsured motorist coverage applies when another driver is at fault for a collision but either has no insurance or not enough insurance to cover the injured person’s medical bills and other damages. Importantly, this coverage also applies in hit and run cases, such as yours, when the identity of the at fault driver cannot be ascertained.

In order to protect yourself against hit and run drivers, uninsured drivers, and drivers carrying the minimum amount of liability insurance (which is $15,000 in California), it is best to make sure you protect yourself with uninsured/underinsured coverage.

How does it work?

With this coverage, your own insurance company covers your losses as if it were the at-fault driver—the insurance company steps into the shoes of the at-fault driver. In a UM/UIM case, you will make a claim against your own insurance company up to the amount of your purchased coverage. In some ways, UM/UIM cases are advantageous. Because you are in a contract with your insurance company, your insurance company has a duty to treat you fairly and regard your interests equally as its own interests. Unfortunately, you will not be entitled to a jury trial on these cases. UM/UIM cases are typically resolved by settlement or through an arbitration process (trial in front of a neutral “judge” agreed upon by the parties).

If you are injured in a hit and run accident, specific rules apply in order to trigger UM coverage.

- First, there must have been contact between your vehicle and the hit and run vehicle.

- Second, within 24 hours after the accident, it must be reported to the police for the jurisdiction in which the accident happened.

- Third, within 30 days of the accident, you must provide your insurance company with a sworn statement that you were injured and that the person causing injury is unknown. Facts explaining the same must be provided in the sworn statement. Typically, a copy of the police report showing hit and run will be sufficient to meet this requirement. These requirements are set forth in California Insurance Code section 11580.2(b)(1) and (2).

Will making a claim increase my insurance premiums?

In California, it is illegal for an insurance company to raise rates when a policyholder brings a claim and was not at fault. (California Insurance Code Section 491). As long as the other driver was the cause of the accident, your premiums should not increase. If there is an increase in the cost of your coverage based on claims activity made necessary by the fault of another, this should be reported to the California Department of Insurance.

Do not concern yourself with the fact that payment is coming from your own insurance company versus the adverse driver or his/her/their insurance company. This is coverage that you have paid for and the insurance company is best equipped to bear the loss. The insurance company is free to seek reimbursement from an uninsured driver should that be feasible.

How long do I have to resolve my case?

Generally, in a UM case, you have two years from the date of the incident to either settle your claim or make a “demand for arbitration” – a process where you formally notify your insurance company that you would like to resolve your case by arbitration. Your insurance company has an obligation to keep you informed of these deadlines and requirements throughout the process.

So often, we think of insurance as a means to protect our assets and property. It is equally important, however, to remember to protect yourself against uninsured and underinsured motorists who may cause you harm. Review your insurance policy to see if you have the applicable coverage.