Written By Chris Dolan

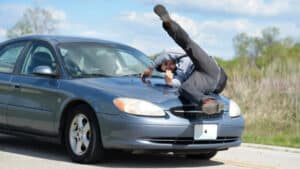

This week’s question comes from Rob in Foster City, who writes: I was in SoMa last weekend, and got in a motorcycle crash. Coming home late at night on my motorcycle, when a van in the left lane beside me swerved into my lane nearly hitting me. I jammed on my brakes and hit the back of the van. The driver said he had no insurance. The van he was driving belonged to the company he worked for. I broke my wrist, and my bike is a wreck. What can I do?

Thank you for your question, Rob. I started riding motorcycles as a teenager and, as a lawyer, regularly represent injured motorcyclists. One of the most common scenarios in the motorcycle crash cases I litigate is when a driver, without signaling, cuts off a motorcyclist or turns suddenly from the opposite lane in front of the motorcyclist. In both cases, the resulting collision can be fatal to the motorcyclist. I am relieved your injuries, while serious, were not life-threatening.

Here, the van driver violated California Vehicle Code Section 21658, which states,

“Whenever any roadway has been divided into two or more clearly marked lanes for traffic in one direction,” it is the rule that “(a) A vehicle shall be driven as nearly as practical entirely within a single lane and shall not be moved from the lane until such movement can be made with reasonable safety.”

I assume the damage to your motorcycle was more than $750. If that is the case, you have to report the accident to the DMV within 10 days of the accident. If you have not already filed the report, go the DMV website, search for Form SR-1, complete the form and send it in right away to the DMV.

You didn’t mention whether you have motorcycle insurance. Assuming you do, you need to ask your agent about whether your insurance policy contains uninsured and/or underinsured motorist coverage. What is uninsured and underinsured motorist coverage? Let’s start with what it isn’t.

When we think of insurance, we think of liability insurance. It protects your assets if you are at fault for an accident and you hurt someone or damage someone else’s property.

Liability insurance does not, however, protect you from damages you suffer in an accident that is someone else’s fault. That’s where uninsured and underinsured motorist coverage applies. Because many drivers in California violate the law and drive without insurance – or have a bare bones policy – California law requires insurance companies to offer consumers this coverage.

Even though the other driver did not have insurance, your insurance policy may be sufficient to cover both the financial loss you suffered – your wrecked bike and any days missed from work – as well compensate you for your broken wrist and medical expenses due to the collision.

What happens if you don’t have insurance?

I hope that is not case. But if it is, the company that owned the van may be legally responsible for your motorcycle crash injuries under the legal doctrine respondent superior, which is Latin for “let the master answer.” The doctrine is codified in California Civil Code Section 2338. It holds an employer responsible for the torts (wrongs) committed by its employees that fall within the “scope and course of their employment.”

You have to show that that the employee was negligent (acting in a manner that was unreasonable or illegal), and that the employee was also involved in the employer’s business enterprise at the time of the collision.

Here, the employee’s negligence is clear: He violated the vehicle code. Was the van driver also involved in the employee’s business? If he was delivering an item for the company or returning the van to the company parking lot after he completed his work shift, the answer is yes.

Determining if an employer is legally responsible for an employee’s negligence requires a thorough investigation of the facts. I suggest you consider contacting an experienced motorcycle crash attorney to advise you further on your legal rights and remedies.